What if you could redirect half of your taxes to your kid’s school? You can! We’ll sort of. In Alabama there is something called the Alabama Accountability Act and it allows taxpayers with an Alabama Income Tax Liability to choose for themselves where their tax money goes! I know it sounds too good to be true and there are some hard parts for the schools but the bottom line for the taxpayer is easy: put your money in the general fund or in your local schools, your choice. Oh and if you are fortunate enough to be an AMT filer, this is cashflow positive for you, ask your accountant or tax preparer.

If you are interested in doing this, estimate your Alabama Income Tax Liability before the end of 2016 and go to

myalabamataxes.alabama.gov. There you will see a menu on the left that includes a Donate to an SGO option, it looks like this:

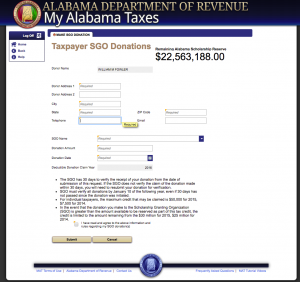

When you click Donate to an SGO you see a screen like this:

When you click Donate to an SGO you see a screen like this:

That screen shows that Alabamians can still donate up to $22 million more before the cap of $30 million is hit. It works like this: If you owe the state $1,000, you pay $500 using the screen above in calendar year 2016. Then, after you pay your $1,000 taxes in April of 2017 you will receive a $500 rebate from the state. It is cash flow neutral for the taxpayer and due to some rules, it is cash flow positive for Alternative Minimum Tax (AMT) filers. Ask your tax professional about that part.

So there is no catch, no more paperwork, just this one screen and a month or two without your rebate check. If you owe $13,000 in income tax to Alabama your “donation” could scholarship a child. Imagine doing that while having it cost you nothing at all. Please. Take the time to do this.