End of Year Appeal, with a Twist

Over the weekend, you are likely to have gotten an appeal from a charity, perhaps one you’ve supported in the past. But, Lincoln is different from other things you support. Lincoln is completely Local. It affects families you probably encounter at some point living in Huntsville. Families with whom your kids will play ball. With whom you share a roadway and with whom you vote. Personally, I am big supporter of the Nature Conservancy and The Land Trust of North Alabama but I am bigger supporter of Lincoln. Why? Because it’s about people, specifically kids, that need the help and guidance of successful families if they are to be productive citizens and share in civil society.

Lincoln is not a hand-out. It’s a hand-up. We understand what enabling looks like and we work against it. Instead, we offer families who legitimately want to engage in their own success to come to our school and to our neighborhood. If they meet their goals, they will succeed and break the cycle of generational poverty. Lincoln Village is working to transform a small part of Huntsville by building up one family at a time and it’s working.

Not Asking for a Check

But, we are not asking you to write us a check. We’ve done our homework and we are going to work smarter than that. Because of a law called the Alabama Accountability Act, Alabama Taxpayers can redirect a portion of their state tax liability to one of several Scholarship Granting Organizations, or SGOs. SGOs are authorized by the state to accept these payments and then to provide scholarships to families with K-12 students currently attending a low performing school. The parents of those kids can apply with an SGO and if they qualify they can receive $6,000 to $10,000 per year to attend certain private schools of which Lincoln is one.

Too Good to be True

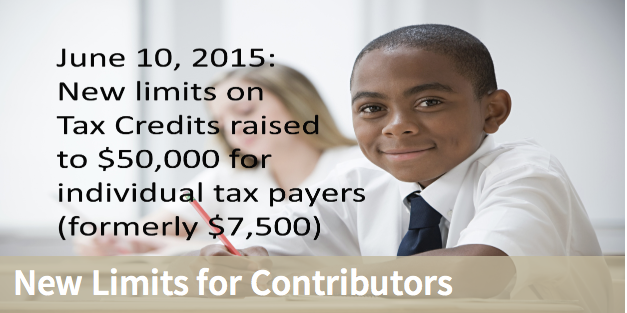

To be clear, this is not a donation, it is a way for a limited amount of money, up to $30 million, to be redirected to local private schools. It is money that you would be paying into the general fund of the State of Alabama anyway. This law allows you to redirect up to half of your Alabama Income Tax Liability into these SGOs. They are allowed a small administrative fee to process the scholarships and both of the groups with whom Lincoln works are exceptional managers of the funds. This really is a too-good-to-be-true opportunity for Lincoln, there is no downside for the taxpayers or for the school.

So, finally, when you go to pay your Alabama Income Tax. Please please please choose to redirect the maximum amount allowed to one of the SGOs with which Lincoln Academy has a relationship: Scholarships for Kids in Birmingham or RocketSGO in Huntsville. For this last push, we would ask that you please choose Scholarships for Kids over RocketSGO as they are still a little short of their budget and they are our valued partners in education. Thanks for reading. If you have a question please comment on this blog post and I’ll reach out.